Key Capabilities

Stop carding, scalping, and transaction fraud to stop fraud, protect revenue, and enable legitimate purchases.

Frictionless Verification Challenges

Block bots at the edge without adding friction for real users with scenario-optimized, customizable verification challenges, Precheck and Human Challenge.

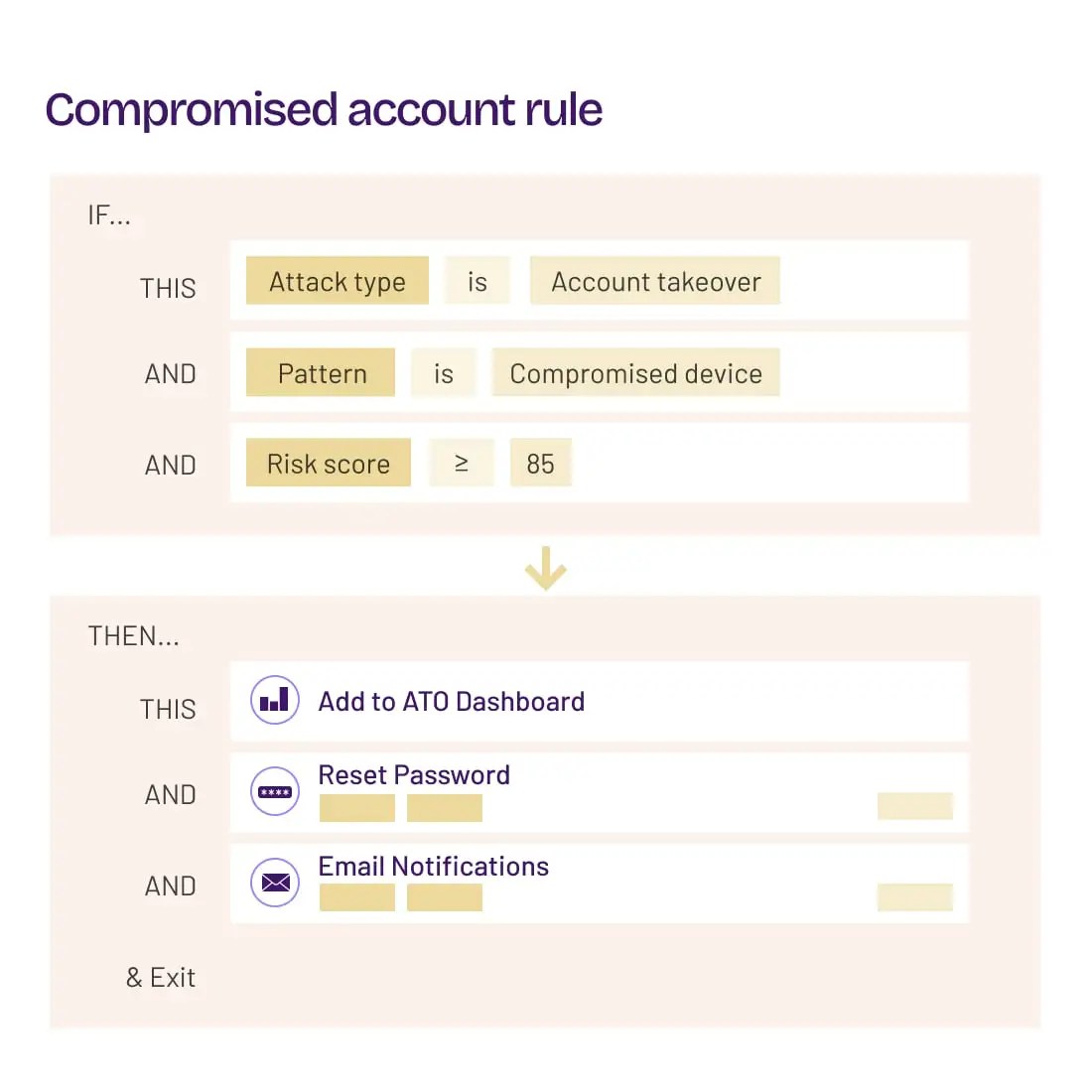

Reduce Risk Before the Point of Transaction

Evaluate user activity within accounts for signs that the account has been compromised, and take action to remediate the account before transaction fraud occurs.

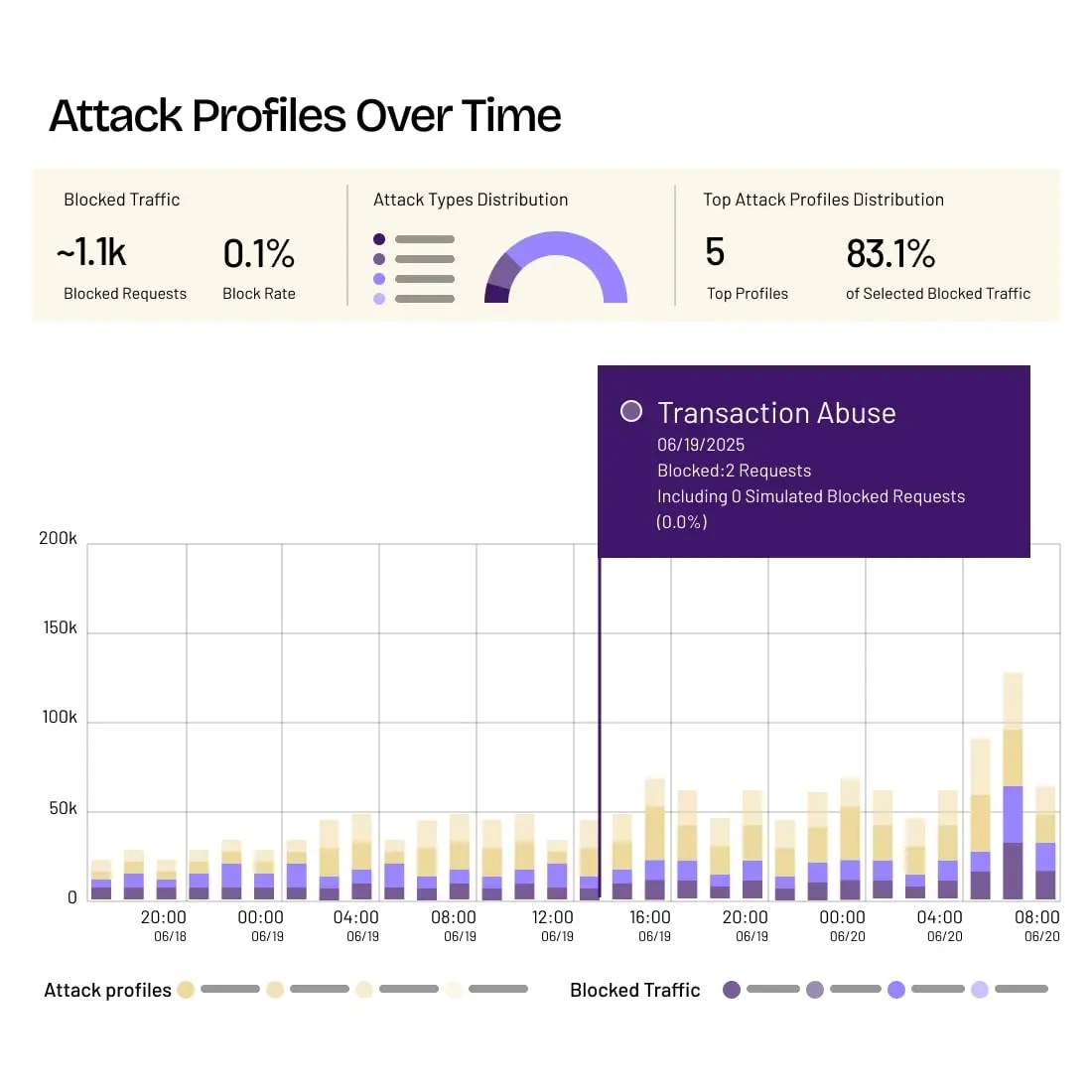

Get Granular Visibility and Control

Pinpoint distinct bot attack paths and changing behaviors. Respond to malicious traffic with customizable actions, including hard blocks, soft mitigation, and triggering internal workflows.

Protecting Customers from Evolving Risks

HUMAN is trusted by global organizations across industries to stop fraudulent transactions, including carding, scalping, and inventory hoarding.

Threat Intelligence:

The HUMAN Element

The Satori Threat Intelligence and Research Team uncovers, analyzes, and disrupts cyberthreats and fraud schemes that undermine trust across the digital landscape, delivering cutting-edge research that strengthens protection for customers and thwarts bad actors for a safer internet.

Explore Satori

Secure Your Transactions with HUMAN

Detect and mitigate carding, scalping, inventory hoarding, and transaction fraud with HUMAN Sightline.

Learn More

FAQ

What is transaction fraud?

Transaction fraud refers to any unauthorized or deceptive use of payment systems, typically involving stolen credit card information, fake accounts, or manipulated transactions. Fraudsters may use bots to automate these attacks at scale, testing stolen payment credentials or making fraudulent purchases. Without strong transaction fraud detection, businesses risk financial loss, increased chargebacks, and damage to customer trust.

How is transaction fraud detected?

Effective transaction fraud detection relies on monitoring behavioral signals, analyzing transaction patterns, and identifying anomalies that indicate malicious activity. Fraudsters may display telltale signs such as rapid transaction attempts, mismatched geolocation and payment data, or the use of known compromised devices. HUMAN’s platform uses machine learning and behavioral analysis to spot these red flags in real time, helping businesses stop fraud before it escalates.

How do you prevent fraudulent transactions?

Transaction fraud prevention requires a layered security strategy that goes beyond basic filters. This includes device fingerprinting, behavioral analysis, and continuous monitoring to distinguish real customers from bad actors. The HUMAN transaction fraud prevention solution helps businesses stop fraudulent transactions at the source by identifying and blocking malicious automation before it can complete the attack.

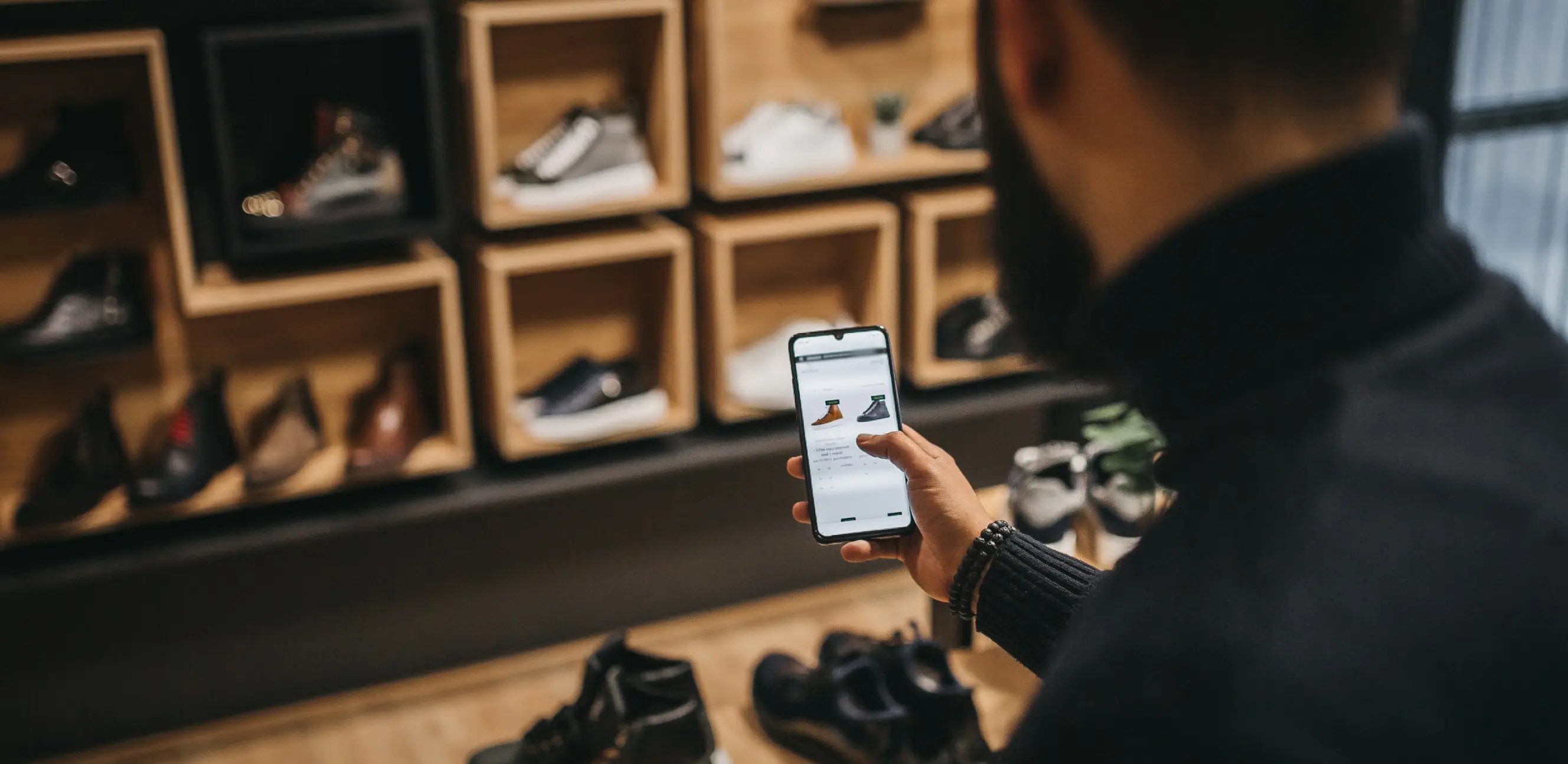

Is HUMAN used for e-commerce cybersecurity?

Yes, HUMAN plays a critical role in e-commerce cybersecurity by protecting businesses from automated threats that target online transactions. From account takeover and fake accounts to transaction fraud prevention, HUMAN ensures that digital commerce remains secure, seamless, and free from fraudulent activity that can erode consumer trust and impact revenue.

Does HUMAN stop other types of bots?

Yes, in addition to transaction fraud detection, HUMAN defends against a wide range of automated threats including credential stuffing, scraping, ad fraud, and inventory hoarding. Our solutions are designed to safeguard the full customer journey by blocking malicious bots across web, mobile, and API environments.

Request a Demo